If you never read anything else I've written, please read this.

Everyone Told Me It Was The WRONG TIME To Buy In Australia – and they were right!

“The World is uncertain - Now is not the right time to buy property in Australia”

“Australia’s house prices are crazy, they have to crash”

“It’s best to wait and watch the Aussie market - see what happens”

"Who knows what interest rates will do? I will wait and see what happens"

“There is a Bubble in the Australian house market”

"Prices are WAY too high in Australia right now"

You've probably heard all of these - and more.

It's mostly well-meaning but completely uninformed.

While there is certainly truth in the fact the world is very uncertain, here is a quick story:

In the mid 1980's I started my business marketing Australian property in Hong Kong, and was MUCH younger and WAY less experienced. But It was going very well.

South China Morning Post 1986:

Yes, it was all going very well.

September 29, 1987 :

And I was on the front page of the SCMP just 20 days before everything changed forever:

BLACK MONDAY 19 OCTOBER 1987.

I THOUGHT MY CAREER WAS OVER BEFORE IT HAD EVEN BEGAN.

On that day, stockbrokers in New York, London, Hong Kong, Berlin, Tokyo and just about any other city with an exchange stared at the figures running across their displays with a growing sense of dread. A financial strut had buckled, and the strain bought world markets tumbling down.

All of the 23 major world markets experienced a sharp decline.

When measured in USD, 8 markets declined by 20% to 29%. 3 by 30 to 39% and three by more than 40%.

I had just opened a NEW revolutionary business in Hong Kong, one nobody had done before - Australian property marketing to international buyers.

And two of the three markets that declined by more than 40% mentioned above were HK and Australia!

There was world panic.

I was told “you’ve joined the (real estate) industry at the worst possible time” and I thought so too.

I was fearful.

Very fearful.

The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

It’s not the time to invest in real estate "the experts" said.

But then something strange happened.

My business took off! It went crazy!

SCMP 8 MAY 1998, LESS THAN A YEAR AFTER ‘BLACK MONDAY’:

You see there was a “flight to safety” as investors raced into real estate, even though Australian interest rates were around 13.5% and rising.

The Sydney market was on fire, and my business in HK was going through the roof!

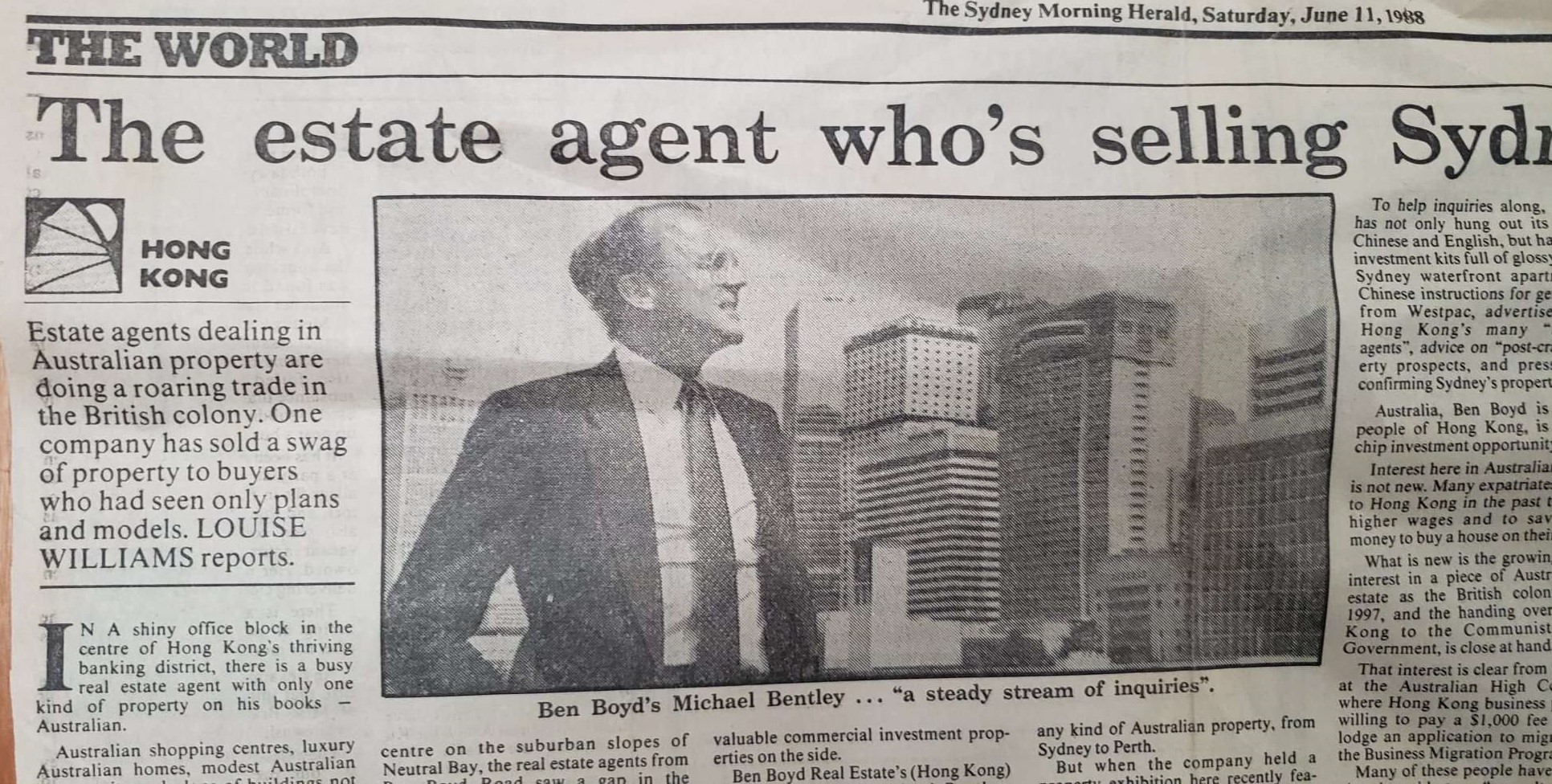

I was featured all over the media including this story in the Sydney Morning Herald in June 1998:

Then, less than a year later, my world was again thrown upside down,

Interest rates were in the double-digits throughout the 1980’s, because inflation was also very high (mostly between 6-10 percent in the second half of the 80’s).

However, things took a nasty turn when the average standard variable mortgage rate jumped from 13.5 percent in June 1988 to 17 percent in June 1989, and unemployment was 6% and heading to 11%, and by July 1990 Australia was in recession.

Don’t touch real estate everyone said.

Then in the early nineties we had a full recession in Australia.

Don’t buy real estate now they said.

And low inflation with the headlines all saying values could never rise if inflation is low.

Don't invest in Australian property.

Then in the late 1990’s accelerated depreciation on property investments was removed, and major changes to Capital Gains Tax were introduced.

Without tax benefits property investing is over they said.

In 2008 there was the global financial crisis, and the collapse in house prices was predicted.

“Experts” said the falls would range from 20% to 60%.

By 2015 Australia’s house prices were in a “bubble” they said, don’t buy!

Then China - Australia’s largest trading partner- faced its own stock crash also in 2015.

It’s going to be an absolute disaster for property in Australia they said.

By 2017 prices had reached "unprecedented levels" and the experts suggesting waiting for prices to fall before buying. s

Investor loans became harder to obtain.

There are no loans available, it’s not a good time to buy. Prices won’t rise.

The onset of Covid in 2020 bought more doomsday forecasts and that now was NOT the right time to put any money into property.

"CBA warns Australia risks 32 per cent house price crash"

MAY 2020

In 2021 the Victorian Budget increased property taxes.

Don't invest in Melbourne property people started saying.

HOUSE PRICES SOARED INSTEAD OF CRASHING!

In 2022 inflation hit, and interest rates went up.

Don’t touch real estate everyone said.

By 2024 Australian house prices had risen by 27% over the previous 3 years, Perth by 52%, Brisbane by 49% and Sydney by 14%.

Melbourne has fallen behind this growth cycle but is likely to "catch-up" between 2026 to 2028.

Consistently for the past 35 years "experts" have been telling me that it is a mistake to buy now in Australia as "the time is not right".

You see, actually what time has taught me is that:

There is no “best” time or “worst” time to buy property.

So rather than just talking about going out and buying a property, the right time for you to consider investing is when you can afford to.

In other words, perhaps it's better to buy when it suits you financially, when you have the deposit, when you have reliable income, not when it's "the right time".

If you wait for the “right time” to buy you’ll never buy anything at all.

But the fact is, any time could be the worst time for you personally to buy a property… or it could be the best time to buy.

It truly depends on your own goals, budget, timeline, risk profile and circumstances as to whether this is the year to buy.

But assuming you have sought out the right research, and have the deposit and access to financing, perhaps it would be more correct to say the biggest mistake you can make is not to own any property at all.

I have been personally helping many others recently secure their own piece of Australia through my exclusive and affordable Apartment buyers service.

Where I assist people through DATA AND RESEARCH and my vast experience to help make sure they don’t make an expensive mistake and purchase at a fair price in today’s market.

If you want an even more detailed discussion of these concepts, schedule a free 30-minute consultation with me by going here.

Or just WhatsApp me!

I have NO properties to sell! So don't feel by calling I will be trying to sell you a property. I do offer an EXCLUSIVE, WHITE GLOVES advisory service, which suits those looking for a unit or apartment, perhaps 1 in 100 people. The rest of the time I provide an no obligation, free, 45 minute call to anyone who would like to discuss the market. If I give you great advice, I am sure you will refer others to me!

That's how my business has grown!